Why That Audi is Calling Your Name (And How to Answer Smartly)

The Magnetic Pull of Luxury

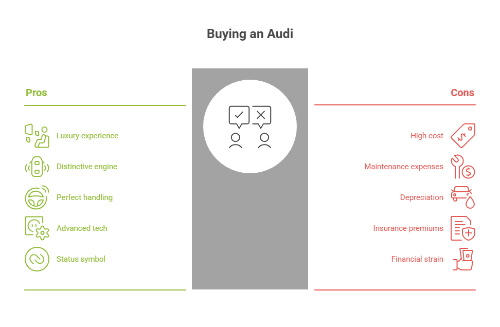

Finance Audi decisions require careful consideration, but I get it. There’s something absolutely magnetic about sliding behind the wheel of an Audi. It’s not just about getting from point A to point B—it’s about that moment when you press the ignition and feel the engine respond with that distinctive German purr. It’s the way the steering wheel feels perfectly weighted in your hands, how the advanced tech seamlessly integrates into your drive, and yes, let’s be honest, it’s also about that little thrill you get when people notice what you’re driving.

But here’s the thing—and I’m speaking from years of helping people navigate these waters—wanting that luxury experience and being able to afford it responsibly are two very different conversations. The good news? With the right approach, you absolutely can make both happen.

Why Getting the Financing Wrong Can Haunt You

Let me tell you about “Mark”—a sharp young engineer I met a few years back. He’d just landed a great job and was so excited about finally being able to afford his dream car that he walked into the first dealership he saw and signed on the dotted line that same day. The monthly payment seemed manageable, the car was gorgeous, and he was over the moon.

Fast forward eighteen months, and Mark was sitting in my office, stressed and struggling. That “manageable” payment had become a crushing burden when he factored in the sky-high interest rate, expensive insurance, and maintenance costs he hadn’t anticipated. He eventually had to let the car go, taking a massive hit to both his credit score and his confidence.

Mark’s story isn’t unique—I’ve seen it play out dozens of times. The difference between driving your dream car and having it become a financial nightmare often comes down to one thing: taking the time to understand your financing options before you fall in love with that specific car on the lot.

Decoding the Financial Maze: What You Really Need to Know

Breaking Down the Financing Fundamentals

When I first started helping people with car financing, I quickly realized that most folks get overwhelmed by all the terminology. So let’s cut through the jargon and focus on what actually matters to you.

Think of your APR (Annual Percentage Rate) as the true cost of borrowing money. It’s not just the interest rate—it includes fees and other costs rolled into one number. Here’s what I always tell my clients: a difference of even 2% in APR can cost you thousands over the life of your loan. That’s real money that could be going toward your next vacation instead of the lender’s pocket.

Your loan term is simply how long you have to pay back the money. I often see people gravitating toward longer terms because the monthly payments look more appealing, but here’s where it gets tricky. Let me show you what I mean with a real example:

Same $40,000 loan, different terms:

- Option A: 5% APR, 48 months = $921/month, total interest: $4,197

- Option B: 7% APR, 60 months = $792/month, total interest: $7,525

See the difference? Option B looks cheaper month-to-month, but you’ll pay over $3,000 more in the long run. It’s like paying for the car… and then paying for it again, partially.

What Lenders Really Look At (And How to Make Yourself Irresistible)

Here’s something most people don’t realize: lenders aren’t just looking at whether you can make the monthly payment. They’re trying to predict whether you’ll still be making that payment three years from now.

Your credit history is like your financial report card—it shows how you’ve handled borrowed money in the past. But income is equally important because it demonstrates your ability to keep making payments. I’ve worked with clients who had perfect credit scores but couldn’t get approved because their income was too inconsistent.

The debt-to-income ratio is where many people get surprised. Even if you make good money, if you’re already stretched thin with credit cards, student loans, and other obligations, lenders get nervous. I usually recommend keeping your total monthly debt payments under 40% of your gross income, but under 30% puts you in the sweet spot for the best rates.

The Foundation: Getting Your Financial House in Order

Taking an Honest Financial Inventory

Before you even start browsing those beautiful Audi photos online, we need to have an honest conversation about your money. I know it’s not the fun part, but trust me—this step will save you from a lot of heartache later.

I remember working with “Sarah,” a marketing director who had her heart set on an Audi Q5. She was convinced she could afford it based on her salary alone. But when we sat down and really looked at her finances—the student loan payments, credit card balances, her rent, and all those subscriptions she’d forgotten about—the picture looked very different.

Instead of rushing into a purchase she’d later regret, Sarah took my advice. She spent six months paying down debt and building up her savings. When she finally bought that Q5, she got a fantastic interest rate and could truly enjoy the car without financial stress. Last I heard from her, she still loves that car and has zero regrets about waiting.

Your Credit Score: The Key to Better Rates

Your credit score isn’t just a number—it’s your golden ticket to saving thousands on your Audi financing. The difference between good credit and excellent credit can mean the difference between a 7% interest rate and a 4% rate. On a $40,000 loan, that’s real money.

Here’s my three-step credit improvement plan that actually works: First, set up automatic payments for all your bills. Payment history makes up 35% of your credit score, so this one change can have a huge impact. Second, tackle your credit card balances. Keep them under 30% of your limit, but under 10% is even better. Third, check your credit reports regularly at AnnualCreditReport.com. I’ve found errors on more than half the reports I’ve reviewed with clients, and fixing them can boost your score almost immediately.

Building a Budget That Actually Works

Most people think budgeting for a car means figuring out the monthly payment. But that’s like planning a vacation and only budgeting for the hotel. You’re missing a huge piece of the puzzle.

When I help clients budget for luxury cars, we look at the total cost of ownership. That beautiful Audi A4 might have a $650 monthly payment, but add insurance ($200+ for luxury vehicles), maintenance ($100-150 monthly average), fuel, and those inevitable repairs, and you’re looking at closer to $1,000+ per month total.

I recommend using tools like YNAB (You Need a Budget) or even just a simple spreadsheet to track everything for a few months before you buy. You might discover you’re spending more than you thought in certain areas, giving you a chance to adjust before taking on a car payment.

Your Financing Toolkit: Exploring Every Option

Traditional Bank and Credit Union Loans: The Reliable Route

Banks and credit unions are often your best bet for competitive rates, especially if you have good credit and an existing relationship. I’ve seen clients save 2-3% on their interest rates just by checking with their credit union first.

Here’s a pro tip I share with everyone: get pre-approved before you shop. When you walk into that dealership with financing already secured, you’re in a completely different negotiating position. You know exactly what you qualify for, and you can focus on negotiating the car price instead of getting distracted by payment discussions.

Leasing: Lower Payments, But Is It Right for You?

Leasing can be tempting because the monthly payments are typically lower. For some people, it makes perfect sense—especially if you like driving newer cars and don’t put a lot of miles on your vehicle.

But I always warn clients about the potential pitfalls. I had a client who leased a gorgeous Audi and then got a new job that required more travel. By the end of his lease, the mileage overage fees cost him nearly $2,000. That “affordable” lease suddenly wasn’t so affordable anymore.

If you’re considering leasing, be honest about your driving habits and lifestyle. Do you take long road trips? Do you have a long commute? Are you the type of person who gets attached to your car? If so, leasing might not be your best option.

Personal Loans: The Unconventional Path

Personal loans for car purchases aren’t common, but they can make sense in specific situations. If you’re buying from a private party, or if you have credit challenges that make traditional auto loans difficult, a personal loan might be worth considering.

Just remember that personal loans typically come with higher interest rates because they’re unsecured. You’ll want to run the numbers carefully to make sure it makes financial sense.

Mastering the Art of the Deal

Do Your Homework Before You Shop

Walking into a dealership without knowing the market value of the car you want is like playing poker with your cards face up. You’re at an immediate disadvantage.

I always tell my clients to spend time on Edmunds, Kelley Blue Book, and similar sites to understand what others are actually paying for the car they want. Don’t just look at the MSRP—that’s just the starting point for negotiations.

Negotiation Strategies That Actually Work

Negotiating doesn’t have to be adversarial. I’ve found that the best approach is to be prepared, polite, and willing to walk away.

Here’s a strategy that worked beautifully for a friend of mine: We visited three different Audi dealerships and got written quotes for the exact same model. When we found the car he really wanted at the fourth dealership, we simply said, “We love this car, and if you can beat this price [showing the lowest quote], we’ll buy it today.” The sales manager initially said no, went to talk to his boss, and came back fifteen minutes later matching the price.

The key was having alternatives. When you’re not desperate to buy that specific car from that specific dealer, you have all the power in the negotiation.

Financing Negotiations: The Second Battle

Getting a good price on the car is only half the victory. You also need to secure favorable financing terms, and this is where having that pre-approval becomes invaluable.

Dealers make money on financing, so they’re motivated to offer you a loan. Sometimes their rates are competitive, sometimes they’re not. Having your pre-approved loan gives you a baseline to compare against.

Watch out for add-ons in the finance office. Extended warranties, paint protection, gap insurance—these can add hundreds to your monthly payment. Some might be worth it, but don’t make those decisions under pressure. Ask for time to think about it, or better yet, research these products beforehand so you know what you actually need.

The Real Cost of Luxury: Planning for the Long Haul

Insurance: The Monthly Reality Check

This is where many people get their first surprise after buying a luxury car. Insurance on an Audi costs significantly more than insurance on a Honda Civic, and for good reason. These cars are more expensive to repair and more likely to be targeted by thieves.

Before you buy, get actual insurance quotes. Don’t guess or assume. I’ve seen people whose insurance costs nearly doubled when they upgraded to a luxury vehicle. Factor this real number into your budget, not some hopeful estimate.

Maintenance: Keeping Your Investment Running

Audi makes fantastic cars, but maintaining them isn’t cheap. Oil changes might cost $150 instead of $50. Brake pads could be $400 instead of $150. Specialized parts and skilled technicians command premium prices.

Research the maintenance schedule for the specific model you’re considering. Look up common issues and repair costs. This isn’t meant to scare you away from the car—it’s about making sure you can afford to keep it running properly for years to come.

Depreciation: The Invisible Cost

Here’s a sobering reality: that $45,000 Audi will likely be worth around $20,000 five years from now. That’s not a criticism of Audi—it’s just how luxury car depreciation works.

Understanding this helps you make better decisions about loan terms and down payments. It also helps you think about how long you plan to keep the car. If you’re someone who likes to change cars every few years, factoring in depreciation becomes even more important.

Your Path to Smart Luxury

The Essential Checklist

Smart Audi financing isn’t about finding the cheapest monthly payment—it’s about getting the best overall deal while ensuring you can comfortably afford the total cost of ownership. Here’s what successful buyers do: they honestly assess their finances, improve their credit scores, research thoroughly, negotiate confidently, and plan for the long-term costs.

The Final Word

That Audi you’ve been dreaming about? It’s absolutely achievable. The key is approaching it with the same thoughtfulness and planning you’d apply to any major financial decision.

I’ve seen too many people either talk themselves out of a car they could comfortably afford, or rush into one they couldn’t. Neither scenario is necessary. With the right preparation and approach, you can make that dream a financially responsible reality.

Your dream car is waiting for you. Now you have the roadmap to make it happen the right way. Go make it happen!