A Knaresborough office equipment supplier’s choice of compliance expert has been copied by more than 20 other franchises in the group!

After realising that applying for an FCA (Finance Conduct Authority) “permission” – required by law for all companies offering credit – was a complex and time consuming process, Clarity Office Solutions (Pennine) Ltd called in Consumer Credit Compliance.

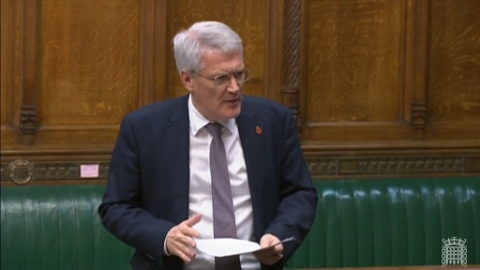

Led by compliance expert Ian Beardmore, CCC – based at Harrogate’s Windsor House – is now handling in excess of 400 compulsory permission application submissions for businesses nationwide.

Bernard Henry, Managing Director of Clarity Office Solutions (Pennine) Ltd – which are suppliers of digital photocopiers/printers and associated services – said: When we received notification that we had to apply for our FCA permission I initially expected the process to be easy.

How wrong I was, and after a few hours of getting nowhere I knew I needed to seek expert help. That’s when I turned to Ian and the CCC team.

They did everything for me and, thanks to them, we have our permission which is great news for us and for our customers too.

Ian and his team are without a shadow of a doubt the compliance experts, and I can’t recommend them highly enough.

My actions have now been copied by more than 20 other offices in the group, who have all turned to CCC to ensure they get their permissions in time.

Consumer Credit Compliance co-director Ian Beardmore said: Every business that offers its clients credit must eventually have a new permission, even if they have been offering credit for many years.

As Bernard says, it is not a two-minute job and is a complex and lengthy process. There are literally tens-of-thousands of companies in the same boat that Bernard found himself, namely requiring an FCA permission and not having the time nor the expertise to complete the task in the allotted timescale.

Mr Beardmore started the business 18 months ago with IT specialist David Petty. CCC now employs a 16-strong team to help cope with the soaring demand of their specialist services.

Mr Beardmore added: Our clients range from sole traders to multi-nationals and they come from every industry within the consumer credit market, from retailers to finance providers to debt management firms and many more.

After taking over regulation of the consumer credit industry a year last April, the FCA introduced a raft of new rules that companies operating in the consumer credit industry have to adhere to, in addition to instigating a new “permission” scheme.

And, failure to submit an application within a pre-determined timescale, will result in companies being unable to offer any form of credit to customers.

Further information about Consumer Credit Compliance is available by visiting their website at www.consumercreditcompliance.co.uk